A Complete Guide To Shipping Cars From The UK To Zimbabwe

Zimbabwe Vehicle Import Regulations

When considering shipping a car or truck from the UK to Zimbabwe, consider these three areas: –

- Age Restrictions: Zimbabwe has introduced a 10 year age limit on cars to Zimbabwe, however trucks are currently unaffected by this regulation.

- Right Hand Drive or Left-Hand Drive: There are no restrictions with this as Zimbabwe allows Left Hand Drive cars as well as Right-Hand Drive.

- Taxes and Customs Duties: While it may look basic, it is essential to take note of all taxes involved to avoid financial implications during the importation process.

Choosing The Right Shipping Method

Simba Shipping currently offers a wide variety of shipping methods available and among them are:

- Roll On Roll Off (or as it is more popularly called RoRo): Picture an underground parking building except it floats. The main advantage of RoRo shipping is that it is the relatively cheaper option of the three options.

Roro Vessel

- Container Shipping: With container shipping, you get a dedicated container for shipping your car. The general rule of thumb is a single car in a 20 ft container and two in a shared 40 ft container.

Container Shipping Vessel

- Air Freight: This is the most efficient of all shipping methods; however, is quite expensive.

Vehicles Secured For Air Freight Shipping

Prices vary depending on the shipping method, port of loading, the make and model of the vehicle (for Saloon cars and 4by4’s) or the size of the vehicle(for heavy commercial vehicles). Contact us for a quote today.

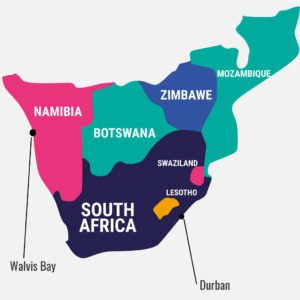

Customs Clearance

As Zimbabwe is Landlocked, we can ship your car to Walvis Bay or Durban and furthermore arrange for car clearance and on-wards delivery with car carriers to PlumTree or Beitbridge depending on the port you ship to. Should you have a clearing agent, they can handle the clearance as well.

At the Zimbabwe border post, the following is required for clearance in Zimbabwe:

- Tax Invoice

- Bill of lading

- Freight invoice

- Road manifest. This is usually generated at the port by a clearing agent.

Taxes And Customs Duty In Zimbabwe

Taxes and Customs Duty depend on the type of vehicle you import, i.e. if the vehicle such as Pick-up Trucks, Vans, Commercial Trucks and Buses are paid for in local ZWD while Cabs, Sedans and SUV’s are paid for in hard USD.

Designed by macrovector / Freepik

The charges levied are Customs Duty, Surtax (which is charged on passenger type motor vehicles that are more than five years old at the time of import) and Value Added Tax.

Note that both Customs Duty and Surtax are calculated on the Value for Duty Purposes or VDP. VAT is calculated on the total of VDP plus the calculated Customs Duty payable.

VAT is then calculated on the total of VDP plus the calculated Customs duty Payable to give a value known as Value for Tax Purposes.

Duty is calculated based on the Cost, Insurance and Freight (CIF) value of the imported goods. The CIF value of the imported goods is an aggregate of the cost of goods, insurance, freight and any Other Charges incurred outside Zimbabwe.

Here is an example of how to calculate your Customs Duty in Zimbabwe:

(Note all values will be in $)

| Year Of Manufacture/Type Of Vehicle | Engine Capacity/Payload | CIF Value in $ | Other Charges in $ | VDP in $ | Duty in $ | Surtax in $ | VTP in $ | VAT in $ | Total Amount Payable in $ |

| 2012 Sedan/Station Wagon | 1495 cc | 6000 | – | 6000 | @40%=2400 | – | 8400 | @15%=1260 | 3660 |

| 2012 Sedan/Station Wagon | 1495 cc | 4000 | 1200 | 5200 | @40%=2080 | 1820 | 7280 | @15%=1092 | 4992 |

You can read our Guide on Customs Duty and Taxes in Zimbabwe with more examples on it.

Please note that ZIMRA at entry points may re-assess values of the motor vehicles if the declared values do not reflect a true market price in the country from where they were bought.

Tax Exemptions

Returning Residents Tax Exemptions

Designed by Stevepb / Pixabay

The following documents are required for returning residents where applicable:

- Employment record, residence permit or student permit.

- Proof that one has completed such studies – for a person who has been pursuing studies.

- Proof that one has terminated such contract – for a person who has been on a contract of employment.

- Proof of such absence from Zimbabwe – for a person who has been on an extended absence from Zimbabwe.

- A certificate stating that such effects and other goods were owned by him/her at the time of his/her arrival and at their time of importation.

- A certificate stating that the rebate has not been granted to him/her in respect of any goods during the previous four years.

- A certificate that such effects and other goods are intended for his/her use in Zimbabwe and will not be used for trade or commercial purposes.

- A written undertaking that such effects and other goods will not be sold or disposed of in any manner.

- A written undertaking to pay such duty as may become due if he/she decides to sell or dispose of in any manner or if he/she decides to leave Zimbabwe for more than six months within 24 months of arrival.

- A written undertaking to notify the Commissioner General of ZIMRA of any change in residential address within twenty-four months of the grant of the rebate. Notification shall be done within fourteen days of such change of address, failure of which one will be liable to payment of a fine

- Satisfactory evidence relating to the acquisition, ownership or purchase of the goods as may be required by the Commissioner.

Returning residents are entitled to a full customs duty and tax rebate provided their car is for personal use and not for commercial use.

Physical Handicapped Persons Customs Duty Exemptions

Also, note that persons with any physical handicap can have their Customs Duty waived. VAT is however still payable based on the value of the motor vehicle plus freight, insurance and any other charges incurred before delivery to Zimbabwe. To get your customs waived you need to produce the following documents:

Current letter from a specialist doctor stating the following:

(i) The nature and degree of disability

(ii) Giving indications of the type of vehicle you could drive under the circumstances

(iii) The extent of disability (whether it is temporary or permanent)

2. An invoice/proforma invoice /document for the recommended motor vehicle which should include the following information:

(i) Engine number

(ii) Chassis number

(ii) Type of transmission

(iv) Year of manufacture

(v) Application letter

(vi) Proof of source of funds

(vii) Copy of identification particulars

(viii) Proof of current residence

Temporary Import Permits

Persons who are not Zimbabwean Residents may from time to time desire to bring in their foreign-registered vehicles into Zimbabwe. Such scenarios require a Temporary Import Permit to exempt them from paying import duties and taxes.

To qualify for one, a visitor will be required to produce the following documents:

- Valid passport of the driver.

- Vehicle registration book in the name of the driver.

- Letter of authority from the registered owner of the vehicle is not owned by the driver.

- Temporary exportation document processed by the Customs authorities in the country from where the visitor is coming

- Carnet de Passage

However, visitors are required to pay USD 10 each time their vehicle enters Zimbabwe.

Sourcing a Car From The UK to Zimbabwe

If you are having trouble finding a suitable car, Simba Shipping has a wide network of trusted car dealers and sourcing companies that can help you find the right car. Contact us today.

Designed by prostooleh / Freepik

This guide is subject to change based on any policy changes by the government and we always recommend checking with a reputable clearing agent before shipping allowing you to know all car shipping costs from the UK to Zimbabwe.

Check out our social pages for any announcements at:

Facebook: ttps://www.facebook.com/SimbaShippingUK

Twitter: https://twitter.com/SimbaShipping

Instagram: https://www.instagram.com/simba.shipping/

Or feel free to contact us at:

Phone: +44 1923 380380

Email: Sales@simbashipping.com

Website: https://www.simbashipping.com/contact-us/

——————————————————————————————————————————————————————————–

Sources

- ZIMRA Website: https://www.zimra.co.zw/index.php?option=com_content&view=article&id=1020&Itemid=108

- Import Rules For Private Individuals: https://www.zimra.co.zw/customs/importation-of-motor-vehicles-by-private-individuals

- Excise Duty On 2nd Hand vehicle change of Ownership:https://www.zimra.co.zw/customs/special-excise-duty-on-change-of-ownership-of-second-hand-motor-vehicles

- Tax rebate on Immigrants: https://www.zimra.co.zw/news/22-taxmans-corner/122-rebate-of-duty-on-immigrants

- Calculation on Importation of Private Motor Vehicles: https://www.zimra.co.zw/customs/calculation-of-duty-on-importation-of-private-motor-vehicles-and-suspension-of-duty-on-motor-vehicle-imports-by-the-physically-handicapped-persons

- Temporary Import Permits: https://www.zimra.co.zw/news/114:understanding-the-temporary-importation-permit-tip-for-visitors-vehicles